Traders may find the financial markets to be both fascinating and intimidating due to its complexity and volatile nature. Although it’s simple to get lost in the statistics and charts, it’s crucial to keep in mind that trading involves both psychological aspects and financial analysis. Effective trading depends on having a solid grasp of the psychology of trading. Trading the vast global financial market which includes currencies, commodities, stocks, indices, and cryptocurrencies will be an emotional roller coaster for most traders. Your ability to trade successfully might depend entirely on how you respond to the ups and downs of these markets.

Many traders or a forex trader experience the negative effects of trading psychology more than the positive aspects. Instances of this can appear in the form of closing losing trades prematurely, as the fear of loss gets too much, or simply doubling down on losing positions when the fear of realizing a loss turns to greed. Traders that manage to benefit from the positive aspects of psychology, while managing the bad aspects, are better placed to handle the volatility of the financial markets and become a better trader.

Understanding psychological biases is important because they can skew our judgement and cause us to act irrationally. Given below is a basic understanding of trading psychology and why it is critical to successful trading:

- Emotions and Trading:

Fear, greed, excitement, overconfidence, and nervousness are all typical emotions experienced by traders at some point or another. Managing the emotions of trading can prove to be the difference between growing the account equity or going bust. The importance of emotions in decision-making is one of the main distinctions between trading and other financial pursuits. Even when traders are aware of the risks, emotions like fear, greed, and hope can have a big impact on their selections. For instance, during a market slump, traders may panic and sell off their holdings, even if the long-term prognosis may still be favourable. This is because of their anxiety. Similar to this, excessive risk-taking by traders motivated by greed can result in huge losses if the market moves against them. Traders may create techniques to regulate their emotions and make more logical, disciplined financial decisions by understanding how emotions can affect decision-making.

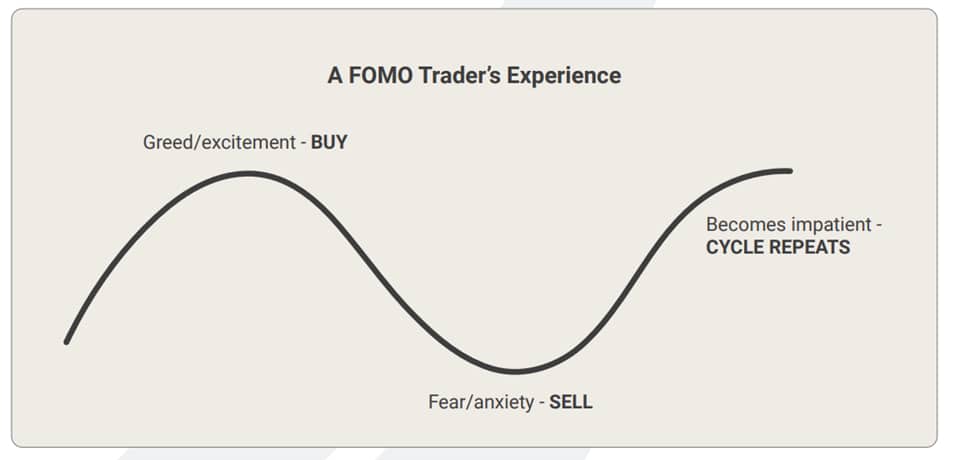

- FOMO (Fear of missing out)

Traders need to identify and suppress FOMO as soon as it arises. While this isn’t easy, traders should remember there will always be another trade and should only trade with capital they can afford to lose. Making rash judgements based on momentary market fluctuations or emotional responses is one of the biggest hazards of trading. Impulsive choices might result in return-chasing or taking on excessive risk in search of quick rewards. These choices can ultimately result in huge losses for a trader and have a significant influence on long-term results. Traders should create a disciplined trading plan based on their long-term objectives and risk tolerance to avoid the hazards of impulsive decision-making. They should put more emphasis on the underlying fundamentals of the firms they trade in and refrain from making judgements based on momentary market fluctuations or emotional responses.

- Greed & Fear

The idea of buying low and selling high is a simple one in theory, but it can be challenging to put into practice. Greed is one of the most common emotions among traders and therefore, deserves special attention. When greed overpowers logic, traders tend to double down on losing trades or use excessive leverage in order recover previous losses. While it is easier said than done, it is crucial for traders to understand how to control greed when trading. While all traders make mistakes regardless of experience, understanding the logic behind these mistakes may limit the snowball effect of trading impediments. Some of the common trading mistakes include trading on numerous markets, inconsistent trading sizes and overleveraging.

- Overcoming Loss Aversion

Loss aversion is the tendency for people to prefer avoiding losses over acquiring gains. In the market, this can lead traders to hold onto losing trades in the hope that they will recover rather than cut their losses and move on. This can be a dangerous strategy as it can lead to significant losses if the investment continues to decline in value. To manage losses in the market, traders need to develop a disciplined approach to risk management. This involves setting stop-loss orders to limit potential losses and diversifying their portfolio to spread risk across different trades. It also involves accepting that losses are a natural part of trading and not letting emotions such as fear and regret influence decision-making.

- The Dangers of Confirmation Bias in Stock Market Analysis

Confirmation bias is the tendency for people to seek out information that confirms their existing beliefs and ignore information that contradicts them. In the market, this can lead traders to make decisions based on incomplete or biased information, which can lead to poor decisions and significant losses. To avoid the dangers of confirmation bias, traders should seek out a variety of sources of information and opinions about the market and individual investments. They should also challenge their assumptions and biases and be open to changing their minds if new information emerges.

- The Importance of Discipline in Successful Trading

Discipline is a critical factor in successful trading. It refers to the ability to stick to a well-thought-out plan and avoid the temptations of short-term market movements or emotional reactions. Discipline can help traders stay focused on their long-term goals and avoid making impulsive decisions that can lead to significant losses. One of the key components of discipline in trading is having a well-defined trading plan. This plan should consider a trader’s goals, risk tolerance, and time horizon. It should also include a clear strategy for diversification, portfolio rebalancing, and risk management.

Summarization:

The psychology of the trading is a crucial aspect for every trader. Making educated and unbiased judgements about your trades requires an understanding of how our emotions and biases may influence such decisions. Traders may succeed in the market over the long run by being disciplined and patient, concentrating on long-term objectives, and avoiding the traps of fear and greed.