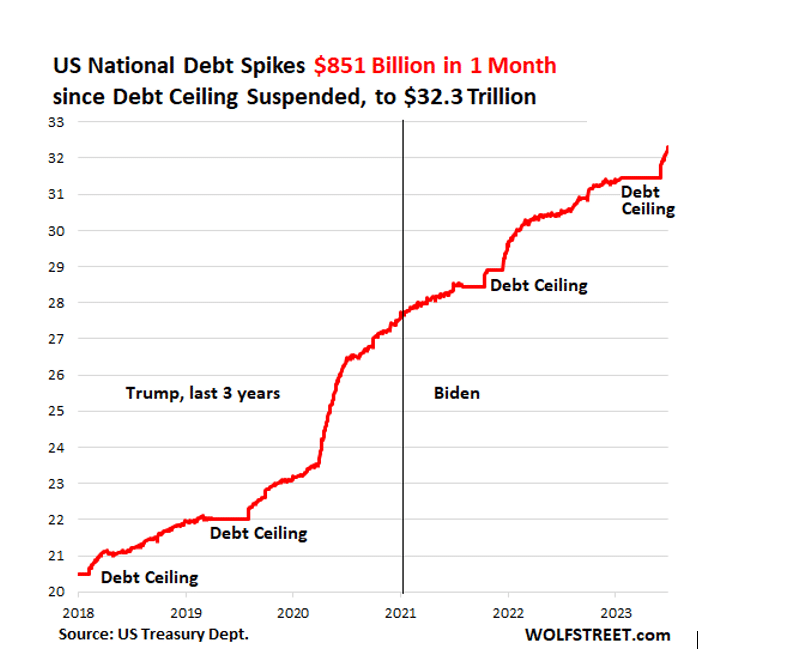

On June 16, 2023, the U.S. Congress passed a bill to suspend the debt ceiling till December 3, 2023, after amending the debt ceiling limit on March 15, 2023, by $480 billion to $31.4 trillion. This debt ceiling deal has received mixed reactions from the market participants, and some say it would shift the market mood index to greed as the market was selling in anticipation of the government defaulting on its obligation. At the same time, some assume it would continue the correction due to increased volatility in the market.

What is a Debt Ceiling?

The U.S. debt ceiling is the maximum amount of money the U.S. government can borrow by issuing bonds. This is a legislative limit on the national debt the U.S. Treasury can incur. Congress sets this limit, which can be amended by majority votes in the assembly. The U.S. debt ceiling has been raised 78 times since 1960.

The Effect of Debt ceiling deal on Liquidity and Market

The Treasury Department is expected to issue an additional $1.4 trillion in Treasury bills through the end of 2023. This represents a significant increase from the $800 billion in Treasury bills issued in 2022. The increased Treasury issuance is expected to drain liquidity from the markets, as investors must sell other assets to purchase the new Treasury bills. This could lead to higher market volatility and make it more difficult for businesses to access capital.

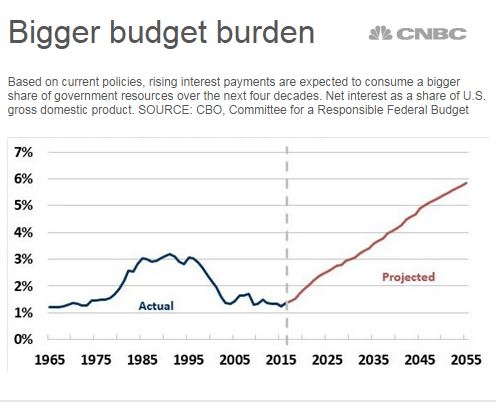

Impact on Interest Rates

The increased Treasury issuance is also expected to lead to higher interest rates. This is because the increased supply of Treasury bills will increase demand for safe assets, pushing up yields. Higher interest rates could make it more expensive for businesses to borrow money and lead to slower economic growth.

Impact on financial markets

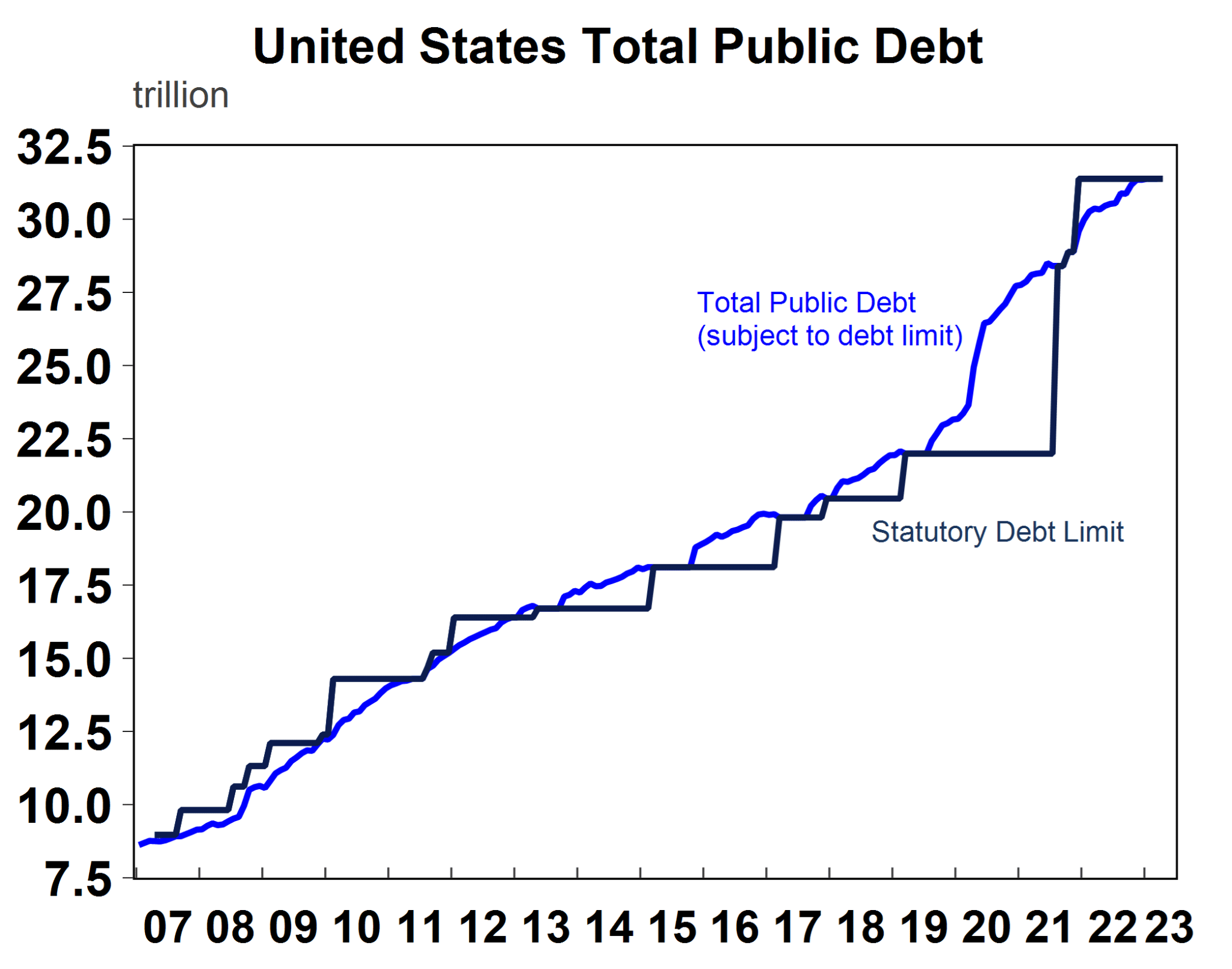

We can already see U.S. national debt increase by 851 billion dollars since the debt ceiling was raised in June. We can expect U.S. national debt to increase by 4 trillion dollars over the next 2 years. Let’s look at what impact this could have on global financial markets.

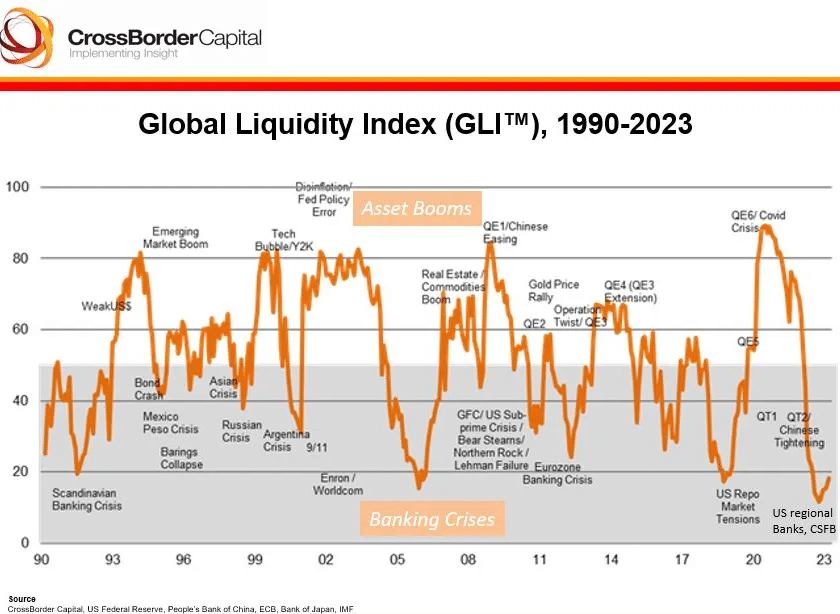

- Liquidity from markets is going to be pulled out on account of the Treasury general account being refilled.

- The FED will continue with its balance sheet reduction along with the TGA refill and that will add more pressure to the liquidity situation.

- Fund flows can shift to broader markets as increased government expenditure will aid manufacturing & service-related sectors.

- With interest rates set to be hiked at least 2 more times by the FED in 2023, we could see more tightening in the markets & mortgage rates could go even higher in the U.S.

- An increasing amount of debt along with rising interest rates, could add pressure on the U.S. dollar.

Summing Up!

Global Markets will closely be watching the action in the bond markets and the schedule of TGA refills for the next 6 months. The FED will also continue its balance sheet drawdown after it had to pause it during the regional banking crisis seen during March. We have seen risk assets perform extremely well over the last few years on the back of QE (Quantitative easing). We are now entering a phase where we will see lower levels of liquidity amid expensive valuations for the major global indexes.